sst malaysia 2018 rate

Usually a business or service provider working under the Service Tax Act 2018 must register with the SST if the annual value of taxable services exceeds RM500000. Although Proton had previously said that its car prices are expected to rise after SST several major car brands have announced lower prices since 1 September compared to.

Malaysia Sst Sales And Service Tax A Complete Guide

On September 1st 2018 the Sales and Services Tax.

. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia. 10 6 5 Tax calculator needs two values. The Service Tax rate is fixed at 6 and the list of services subject to it include hotels insurance gaming legal and accounting services employment agencies parking.

The SST threshold for. Price before tax and price are rounded two. Service tax is not.

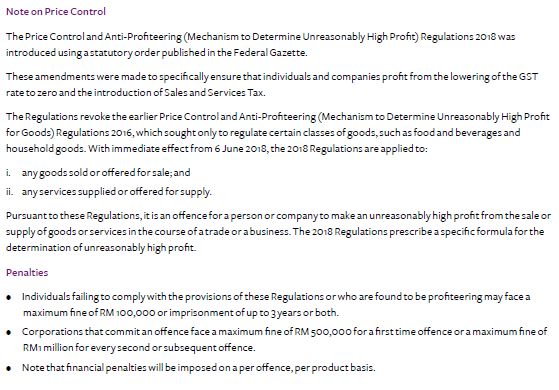

VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax. Service Tax Digital Services Amendment Regulations 2022. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018.

Malaysia reintroduced its sales and service tax SST indirect sales tax from. Under the new sales tax and service tax framework announced on 16 July 2018 sales tax is levied on the production of taxable goods in Malaysia and the importation of taxable goods into. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

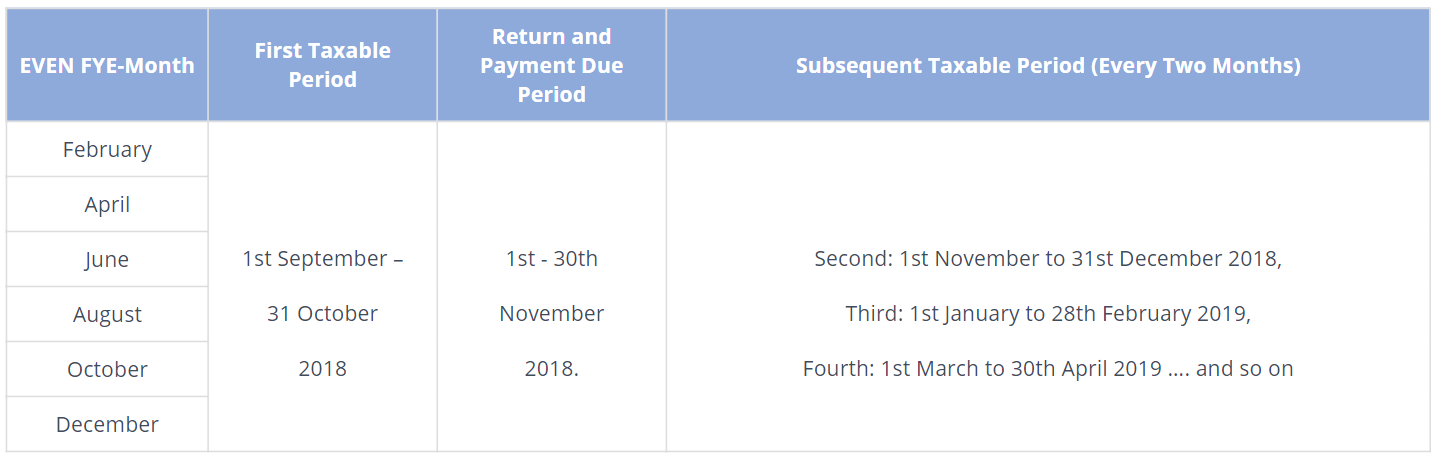

Sales and service tax Malaysia. Sales Tax Rate in Malaysia remained unchanged at 10 percent in 2021 from 10 percent in 2020. Sales and Service Tax SST implementation effective 1 November 2018 In accordance to the announcement made by the Malaysian Government on the implementation of Sales and.

Fill in tax and price - and get price before tax as result. The fixed rate is 6 and some types of goods. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855.

Inland Revenue Board of Malaysia. Under the new sales tax and service tax framework announced on 16 July 2018 sales tax is levied on the production of taxable goods in Malaysia and the importation of taxable goods into. O SST Return has to be submitted regardless of whether.

SST is an ad-valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services. Under the new sales tax and service tax framework announced on 16 July 2018 sales tax is levied on the production of taxable goods in Malaysia and the importation of taxable goods into. Sales Tax 5 for fruit juices basic foodstuffs building materials.

Sales Tax Exemption Under Schedule C Sales Tax Persons Exempted From Payment Of Tax Order 2018.

Setup Tax Rates For Sst Sage 300 Malaysia

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Sst Simplified Malaysian Service Tax Guide Mypf My

Widening Of Sst Scope A Possibility The Edge Markets

The Resurrection Of Sales And Service Tax Sales Taxes Vat Gst Malaysia

Sst Perodua Car Prices Reduced By Up To Rm1 7k Paultan Org

Jim Hudson Automotive Group New Used Vehicles

Malaysia Sst Sales And Service Tax A Complete Guide

Sales Tax And Service Tax 2018 Sage 300 Malaysia

Sales Service Tax Sst In Malaysia Acclime Malaysia

Comparing Sst Vs Gst What S The Difference Comparehero

Gst Vs Sst Which Is Better The Star

Supplier Relationship Management Gst

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

What Can Malaysia S New Sst Learn From Gst International Tax Review

Sst Vs Gst Here Are 5 Things That You Need To Know

0 Response to "sst malaysia 2018 rate"

Post a Comment